from alpha_vantage.timeseries import TimeSeries

import pandas as pd

import matplotlib.pyplot as plt

from sklearn.linear_model import Ridge # Using Ridge regression

from sklearn.model_selection import train_test_split, GridSearchCV

from sklearn.metrics import mean_squared_error, r2_score

from sklearn.preprocessing import StandardScaler # Standardization

import numpy as np

"""

Script to create a predictive model for USD/JPY

This script fetches daily USD/JPY data from the Alpha Vantage API

and builds a model using linear multiple regression to predict the next day's closing price.

The model is built using data over the following periods:

- 1 day

- 10 days

- 100 days

- 1000 days

Each model's performance is evaluated using RMSE and R^2.

"""

# --- Settings ---

api_key = "XXXXXX"

window_size_10d = 10

window_size_100d = 100

window_size_1000d = 1000 # Setting for 1000-day window

# --- Data Retrieval ---

print("---------- Starting data retrieval ----------")

ts = TimeSeries(key=api_key, output_format='pandas')

data, meta_data = ts.get_daily(symbol='USDJPY', outputsize='full')

———- Starting data retrieval ———-

from __future__ import print_function

print(data)

print("---------- Data retrieval complete ----------")

# --- Data Preprocessing ---

print("---------- Starting data preprocessing ----------")

data = data.rename(columns={

'1. open': 'open',

'2. high': 'high',

'3. low': 'low',

'4. close': 'close',

'5. volume': 'volume'

})

data.index = pd.to_datetime(data.index)

data = data.sort_index(ascending=True)

# Feature Engineering

data['price_change'] = data['close'].diff()

data['high_low_diff'] = data['high'] - data['low'] # Difference between high and low

data['close_open_diff'] = data['close'] - data['open'] # Difference between close and open

data['volume_change'] = data['volume'].diff() # Change in volume

# --- Moving Average Calculation ---

data['ma_short'] = data['close'].rolling(window=5).mean() # Short-term MA (5 days)

data['ma_long'] = data['close'].rolling(window=25).mean() # Long-term MA (25 days)

# --- RSI Calculation ---

delta = data['close'].diff()

gain = delta.where(delta > 0, 0)

loss = -delta.where(delta < 0, 0)

avg_gain = gain.rolling(window=14).mean()

avg_loss = loss.rolling(window=14).mean()

rs = avg_gain / avg_loss

data['rsi'] = 100 - (100 / (1 + rs))

# --- MACD Calculation ---

data['ema_short'] = data['close'].ewm(span=12).mean() # 12-day EMA

data['ema_long'] = data['close'].ewm(span=26).mean() # 26-day EMA

data['macd'] = data['ema_short'] - data['ema_long']

data['macd_signal'] = data['macd'].ewm(span=9).mean() # Signal line

# --- Bollinger Bands Calculation ---

data['std'] = data['close'].rolling(window=20).std() # 20-day standard deviation

data['upper_band'] = data['ma_short'] + 2 * data['std'] # Upper band

data['lower_band'] = data['ma_short'] - 2 * data['std'] # Lower band

# Handling missing values

data = data.dropna()

print("---------- Data preprocessing complete ----------")

# Display start and end date of data

print(f"Start date of data: {data.index[0]}")

print(f"End date of data: {data.index[-1]}")

# --- Model Building and Evaluation ---

def create_and_evaluate_model(data, window_size, model_name):

print(f"---------- Starting {model_name} model processing ----------")

X = data[['open', 'high', 'low', 'close', 'volume', 'price_change',

'high_low_diff', 'close_open_diff', 'volume_change',

'ma_short', 'ma_long', 'rsi', 'macd', 'macd_signal',

'upper_band', 'lower_band']].values[:-1]

y = data['close'].values[1:] # Next day's close price

X = X[window_size:]

y = y[window_size:]

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

# Standardization

scaler = StandardScaler()

X_train = scaler.fit_transform(X_train)

X_test = scaler.transform(X_test)

# Ridge regression model and grid search

model = Ridge()

param_grid = {'alpha': [0.01, 0.1, 1, 10, 100]} # Regularization parameters

grid_search = GridSearchCV(model, param_grid, cv=5, scoring='neg_mean_squared_error')

grid_search.fit(X_train, y_train)

best_model = grid_search.best_estimator_

y_pred = best_model.predict(X_test)

rmse = np.sqrt(mean_squared_error(y_test, y_pred))

r2 = r2_score(y_test, y_pred)

print(f"Best parameters ({model_name}): ", grid_search.best_params_)

print(f"RMSE ({model_name}): {rmse:.4f}")

print(f"R^2 ({model_name}): {r2:.4f}")

print(f"---------- {model_name} model processing complete ----------")

return best_model, scaler # Return best model and scaler

# Evaluate models for each time window

model_1d, scaler_1d = create_and_evaluate_model(data, 1, "1-day")

model_10d, scaler_10d = create_and_evaluate_model(data, 10, "10-day")

model_100d, scaler_100d = create_and_evaluate_model(data, 100, "100-day")

model_1000d, scaler_1000d = create_and_evaluate_model(data, 1000, "1000-day")

date

2025-06-25 144.803 145.492 144.604 145.426 0.0

2025-06-24 146.128 146.177 144.509 144.801 0.0

2025-06-23 146.535 148.029 146.005 146.112 0.0

2025-06-20 145.449 146.216 145.119 146.054 0.0

2025-06-19 145.050 145.770 144.732 145.433 0.0

… … … … … …

2006-05-02 113.620 114.000 113.070 113.400 0.0

2006-05-01 113.630 113.840 112.310 113.500 0.0

2006-04-28 114.150 114.470 113.630 113.840 0.0

2006-04-27 114.800 115.110 113.810 114.190 0.0

2006-04-26 114.880 115.360 114.600 114.820 0.0

# Get the latest data

latest_data = data.iloc[-1] # Latest 1-day data

# Prepare features for prediction using each model

features = latest_data[['open', 'high', 'low', 'close', 'volume', 'price_change',

'high_low_diff', 'close_open_diff', 'volume_change',

'ma_short', 'ma_long', 'rsi', 'macd', 'macd_signal',

'upper_band', 'lower_band']].values.reshape(1, -1)

# Get prediction from 1-day model

prediction_1d = model_1d.predict(scaler_1d.transform(features))[0]

# Example: Using the 10-day model

latest_data = data.iloc[-window_size_10d:] # Get the latest 10-day data

features = []

for i in range(len(latest_data) - 1):

features.append(latest_data[['open', 'high', 'low', 'close', 'volume', 'price_change',

'high_low_diff', 'close_open_diff', 'volume_change',

'ma_short', 'ma_long', 'rsi', 'macd', 'macd_signal',

'upper_band', 'lower_band']].iloc[i].values)

features = np.array(features)

# Predict using the last day's features

prediction_10d = model_10d.predict(scaler_10d.transform(features[-1].reshape(1, -1)))[0]

# 100-day model

latest_data_100d = data.iloc[-window_size_100d:] # Get the latest 100-day data

features_100d = []

for i in range(len(latest_data_100d) - 1):

features_100d.append(latest_data_100d[['open', 'high', 'low', 'close', 'volume', 'price_change',

'high_low_diff', 'close_open_diff', 'volume_change',

'ma_short', 'ma_long', 'rsi', 'macd', 'macd_signal',

'upper_band', 'lower_band']].iloc[i].values)

features_100d = np.array(features_100d)

prediction_100d = model_100d.predict(scaler_100d.transform(features_100d[-1].reshape(1, -1)))[0]

# 1000-day model

latest_data_1000d = data.iloc[-window_size_1000d:] # Get the latest 1000-day data

features_1000d = []

for i in range(len(latest_data_1000d) - 1):

features_1000d.append(latest_data_1000d[['open', 'high', 'low', 'close', 'volume', 'price_change',

'high_low_diff', 'close_open_diff', 'volume_change',

'ma_short', 'ma_long', 'rsi', 'macd', 'macd_signal',

'upper_band', 'lower_band']].iloc[i].values)

features_1000d = np.array(features_1000d)

prediction_1000d = model_1000d.predict(scaler_1000d.transform(features_1000d[-1].reshape(1, -1)))[0]

# Get today's exchange rate

today_close = data['close'].iloc[-1]

# Print predictions

print("Today's Exchange Rate:")

print(f"Closing Price: {today_close:.4f}")

print("------------------")

print(f"1-day Model Prediction: {prediction_1d:.4f}")

print(f"10-day Model Prediction: {prediction_10d:.4f}")

print(f"100-day Model Prediction: {prediction_100d:.4f}")

print(f"1000-day Model Prediction: {prediction_1000d:.4f}")

# Calculate average prediction (example)

average_prediction = (prediction_1d + prediction_10d + prediction_100d + prediction_1000d) / 4

print("------------------")

print(f"Average Predicted Closing Price: {average_prediction:.4f}")

Today’s Exchange Rate:

Closing Price: 145.4260

——————

1-day Model Prediction: 145.4468

10-day Model Prediction: 144.8395

100-day Model Prediction: 149.0225

1000-day Model Prediction: 144.7972

——————

Average Predicted Closing Price: 146.0265

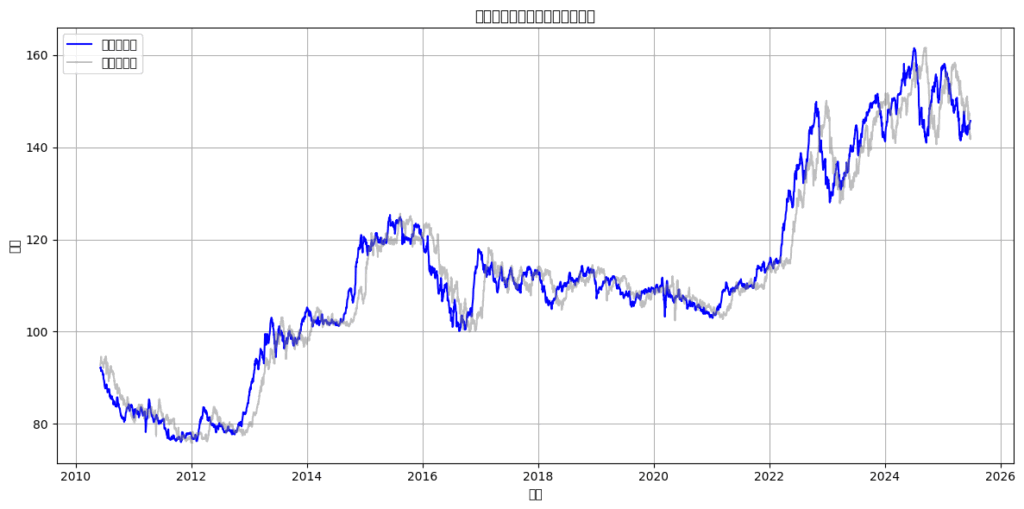

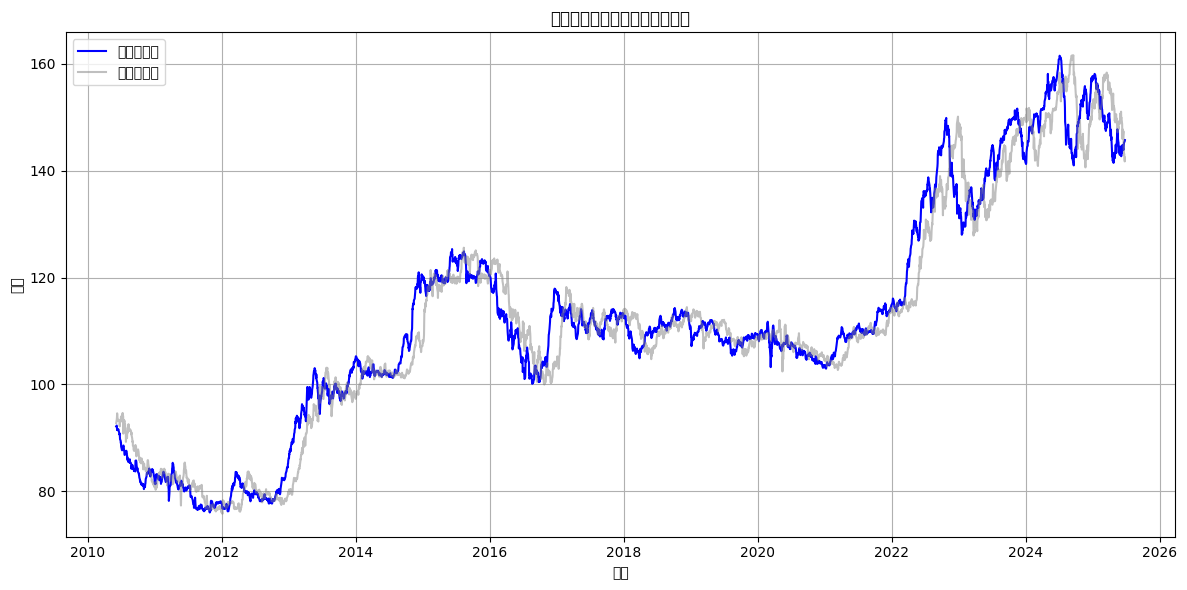

plt.figure(figsize=(12, 6))

plt.plot(dates, average_predictions, label="Average Prediction", color='blue')

plt.plot(dates, data['close'].iloc[start_index: start_index + len(dates)], label="Actual Closing Price", color='gray', alpha=0.5)

plt.title("Trend of Average Predicted Prices by Model")

plt.xlabel("Date")

plt.ylabel("Price")

plt.legend()

plt.grid(True)

plt.tight_layout()

plt.show()