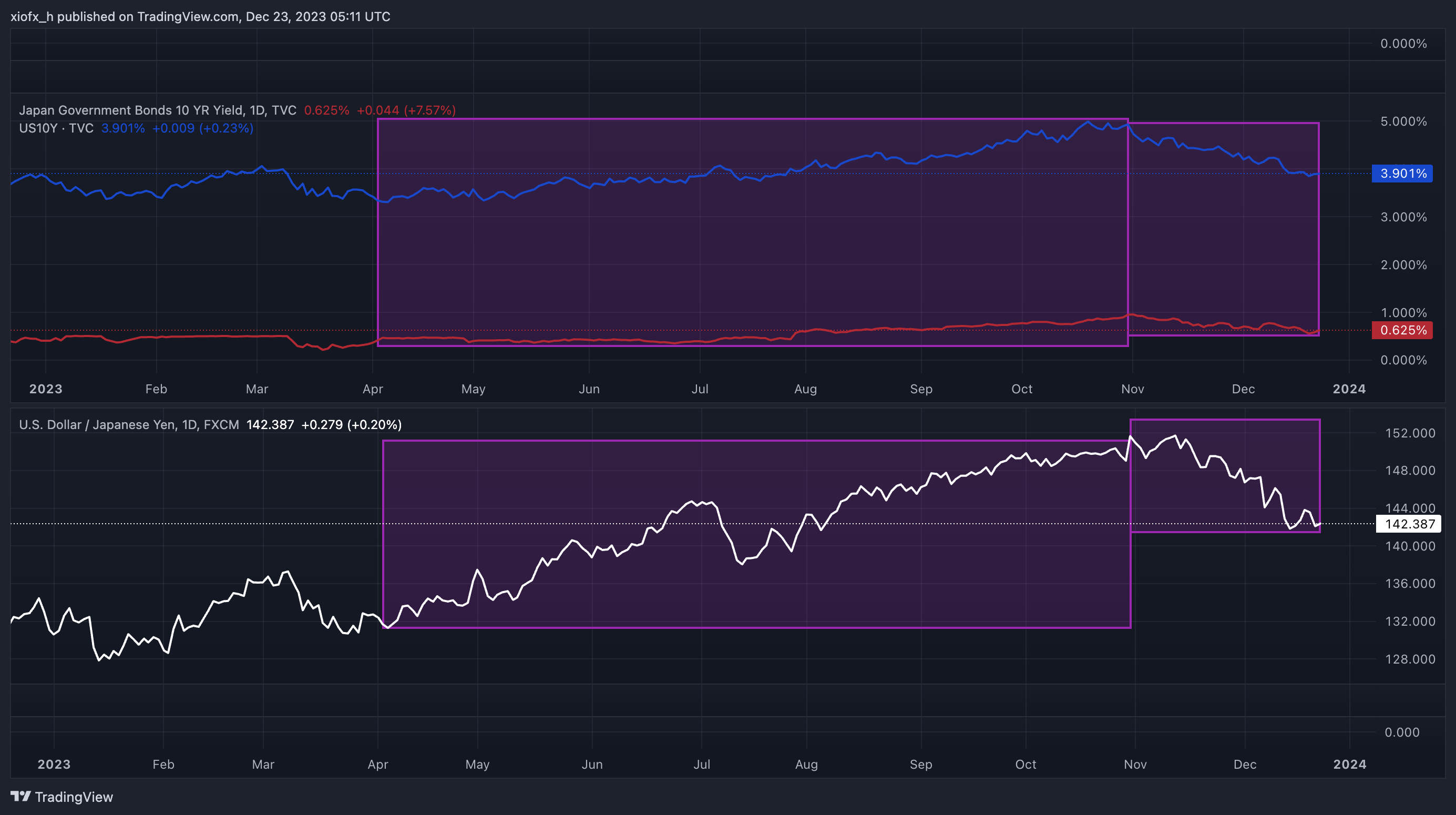

In the first half of 2023, the FOMC’s planned rate hikes opened the interest rate differential and weakened the yen; in the second half of 2023, the yen strengthened in response to the FOMC’s loosening rate hikes. In particular, USD/JPY reverted back to early 2023 after the FOMC indicated around Nov that it planned to lower interest rates next year.

Japan, like other developed countries, raised interest rates slightly, but only by a few percent(less than 1 %) due to concerns about the deterioration of its BS sheet.

US excused multiple planned interest rate hikes to reduce inflationary momentum (the hiest point is around 5%).

Movements in other developed countries. Some of each country was raising interest rates to control inflation

Comparison with other countries. Shows that Japan has not moved dramatically compared to other countrie.

Exciting to see the USD/JPY movement after the FOMC announced that it will ease interest rates next year 3 times, starting next spring at least. Japan, on the other hand, said that leave interest rates hold next year, so the gap should narrow more next year.